What is ROI?

ROI (Return on Investment) is a performance metric used to evaluate the efficiency or profitability of an investment. It tells you how much money you earned or lost relative to how much you invested.

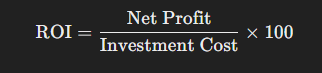

✅ Simple ROI Formula:

Where:

- Net Profit = Total Revenue – Total Cost

- Investment Cost = The amount you spent or invested

📊 ROI in a Business Context

ROI helps businesses decide if an investment (like new equipment, marketing, hiring, software, etc.) is worth it. It helps answer:

- “Is this investment profitable?”

- “Which option gives us a better return?”

- “Are we growing or just spending?”

🔍 ROI Example (Simple)

Let’s say you run a small coffee shop.

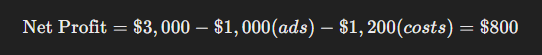

- You spend $1,000 on Facebook ads.

- The ads bring in $3,000 in extra sales.

- Your cost of delivering those goods is $1,200.

- So, your Net Profit is:

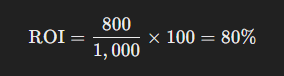

Now calculate ROI:

Meaning: For every dollar you invested in the ad, you got $0.80 in profit. That’s a solid return.

📈 Why ROI Matters to Businesses

- Decision-Making Tool: Helps compare multiple investment options.

- Performance Metric: Measures how well a department or project is doing.

- Budget Justification: Teams use it to justify spending or request more funds.

- Investor Confidence: Investors or owners want to see how money is being multiplied.

🧠 Real-World Applications

1. Marketing Campaigns

- ROI tells if your ad spend brought in enough revenue.

- Example: “We spent $500 on Google Ads and made $1,000 in new sales = 100% ROI.”

2. New Equipment or Technology

- ROI on buying a new machine: Does it save time, reduce costs, or increase output?

3. Employee Training

- Does training improve productivity or reduce costly errors?

4. Website or Software Development

- If you build a new site for $5,000 and it brings $15,000 in new customers, the ROI is high.

⚠️ Limitations of ROI

- Doesn’t Consider Time: An ROI of 100% over 5 years is not as good as 50% in 1 year.

- Ignores Risk: High ROI might come with high risk.

- No Standard Calculation: Different businesses include/exclude different costs.

- Can Be Manipulated: ROI can look good if certain costs are left out.

⏳ Time-Adjusted ROI (Advanced)

To fix the “ignores time” issue, some businesses use:

🔁 Annualized ROI:

Annualized ROI

Where n = number of years

This helps you compare investments with different time frames.

🧾 Quick ROI Comparison Table

| Investment | Cost | Revenue | Net Profit | ROI |

|---|---|---|---|---|

| Facebook Ads | $500 | $1,200 | $700 | 140% |

| New Coffee Machine | $3,000 | $4,500 | $1,500 | 50% |

| Website Upgrade | $1,500 | $2,200 | $700 | 46.6% |

🧮 Bonus: How to Improve ROI

- Lower your costs (do things more efficiently)

- Increase your returns (raise prices, get more leads/sales)

- Target better investments (pick things with better potential)

📊 Free ROI Spreadsheet Template – Download Now!

Want to calculate your business ROI quickly and accurately? I’ve created a fully functional ROI Spreadsheet Template that does all the math for you — just plug in your numbers and let the formulas handle the rest.

✅ Automatically calculates Net Profit and ROI (%)

✅ Perfect for marketing, equipment, or project evaluations

✅ Easy to customize for your own business needs

👉 Click here to download the ROI Spreadsheet Template and start making smarter business decisions today!